what is suta taxable wages

009 00009 for 4th quarter. How they affect you.

Formulate If Statement To Calculate Futa Wages Microsoft Community

It serves the same purpose as the SUTAcollecting taxes from employers for the purposes of providing unemployment benefits.

. Employers pay a certain tax rate usually between 1 and 8 on the taxable earnings of employees. For more information on this new law refer to Unemployment tax changes. An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes.

Your states wage base. Kentuckys range for example is 03 to 9. Generally unemployment taxes are employer-only taxes meaning you do not withhold the tax from employee wages.

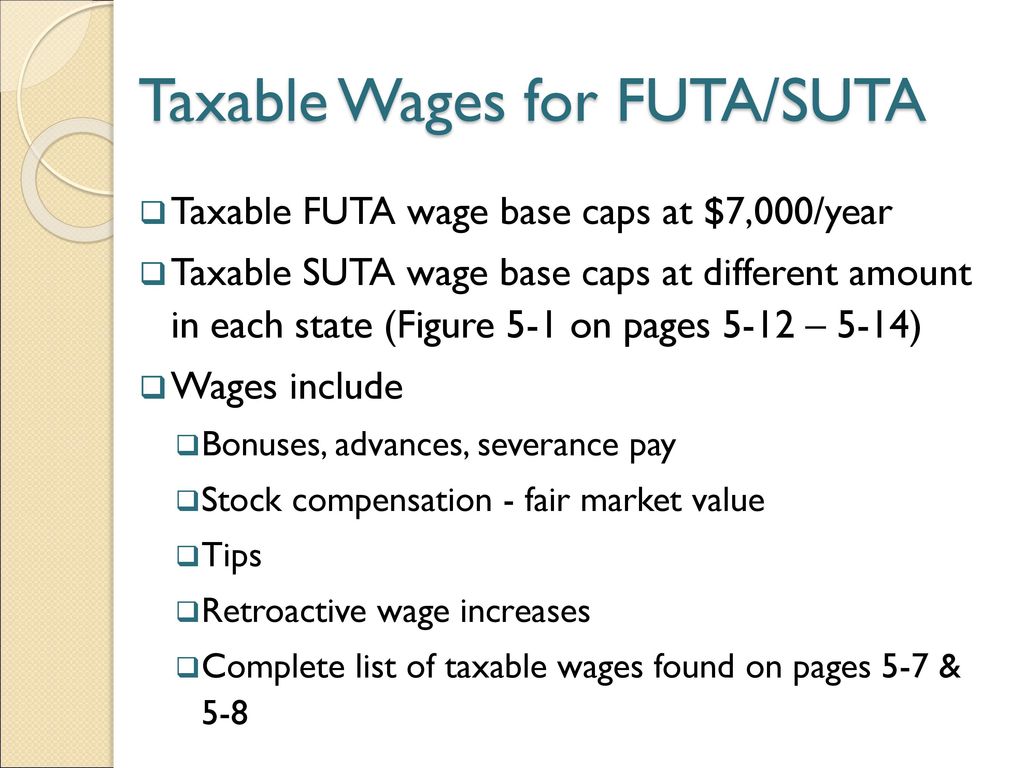

The taxable wage base for 2022 is. SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages. The State Unemployment Tax Act SUTA tax is much more complex.

The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring employers to pay towards a fund. 009 00009 for 2nd quarter. 009 00009 for 1st quarter.

The wage base is the maximum amount of an employees gross income that can be used to calculate SUTA tax. To calculate the amount of unemployment insurance tax payable TWC. The amount of the tax is based on the employees wages and the states unemployment rate.

You pay unemployment taxes on your employees gross wages up to the taxable wage base. In Florida in particular the taxable wage base is among the. The amount each employee was paid for working whether paid as a fixed.

It is a payroll tax that goes towards the state unemployment fund. Special payroll tax offset. Each state decides on its SUTA tax rate range.

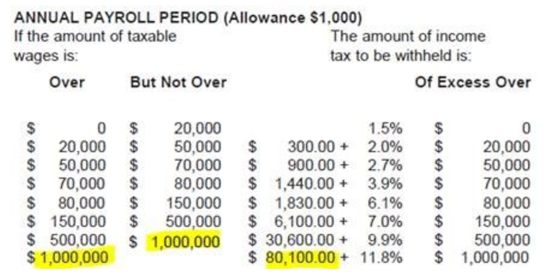

2 days agoQuestion 1 would change the state constitution and create a 4 additional tax on all income earned above 1 million. Assume that your company receives a good assessment and your. However some states Alaska New Jersey and.

The State Unemployment Tax Act known as SUTA is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund. The Taxable wage base for 2022 is 38000. 2022 Tax rate factors.

009 00009 for 3rd quarter. The best negative-rate class was assigned a rate of 1245 percent which when multiplied by the 46500 wage base results in a tax of 57892 while those in the worst rate class pay at the. The ranges are wide.

If someone earns 1 million or less they would not be subject. State Unemployment Tax Act is also known as SUTA state unemployment insurance and SUI. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

You will be liable for state unemployment taxes if the total amount of wages you pay for domestic services in a. That means you dont pay the tax on any. For state unemployment tax purposes only the first 9000 paid to an employee by an employer during a calendar year constitutes taxable wages An employer cannot count wages paid by.

New companies usually face a standard rate. This will depend on the amount of wages that you pay during a calendar quarter.

What Is The Suta Tax And Why Is It Going Up In 2021 Fourth

What Are Employer Taxes And Employee Taxes Gusto

Unemployment Insurance Taxes Iowa Workforce Development

Suta State Unemployment Taxable Wage Bases Aps Payroll

Unemployment Insurance Taxes Iowa Workforce Development

What Is Sui State Unemployment Insurance Tax Ask Gusto

Suta Vs Futa What You Need To Know

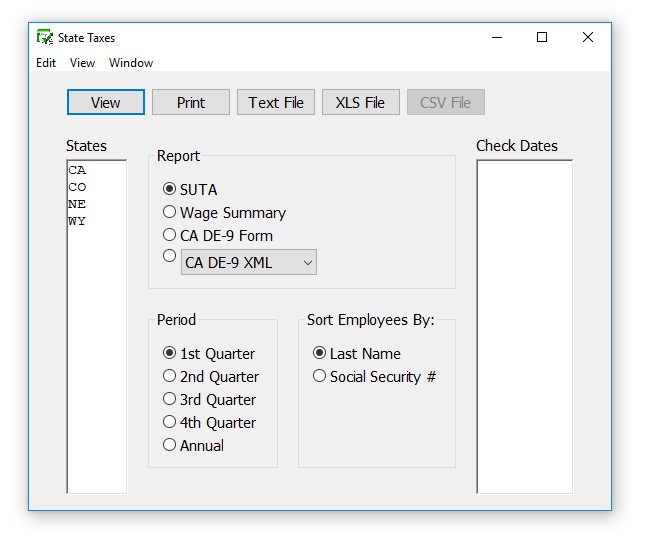

How To Create Suta Taxes Reports In Checkmark Payroll Checkmark Knowledge Base

Understanding Federal Payroll Tax Payments Including Futa And Suta Legalzoom

Fast Unemployment Cost Facts For Utah First Nonprofit Companies

2020 State Unemployment Insurance Taxable Wage Bases

Tax Liabilities Report S247 Asap Help Center

State Unemployment Tax Act Suta Bamboohr

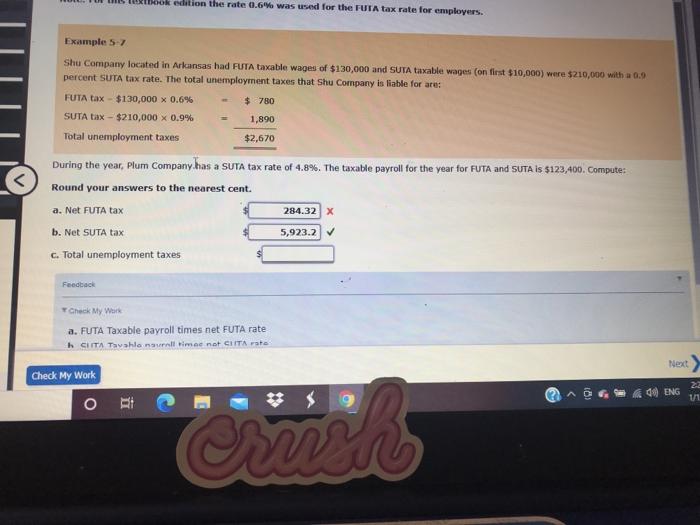

Solved Ook Edition The Rate 0 6 Was Used For The Futa Tax Chegg Com

Federal Unemployment Tax Who Pays Futa Exempt Wages Exempt Employment Futa Tax Rate Wage Base Depositing Reporting Futa Tax Calculating Ppt Download

Chapter 5 Payroll Accounting 2011 Unemployment Compensation Taxes Ppt Download